do nonprofits pay taxes on donations

The research to determine whether or not sales tax is due lies with the nonprofit. Simple flat rate fee.

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship Proposal

Section 501 c of the US.

. The state income tax rates range from 0 to 853 and the sales. A charitable organization according to the IRS works to help the poor defend human rights advance education or science and maintain monuments among others. However items withdrawn from resale inventory and donated to organizations such as nonprofit museums art galleries and libraries are not taxable.

Another would have revoked property tax exemptions for nonprofits that pay executives more than 250000. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount. Still most are exempt under Section 501 c3 which gives an exemption to charitable organizations and lets donors deduct their charitable contributions.

For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for. 1-2006 This information guide provides an overview of how Nebraska sales and use income and withholding tax laws apply to nonprofit organizations. As nonprofit organizations raise funds and solicit donations tracking and properly recording monetary contributions becomes an important function as donors require detailed receipts to claim tax deductions.

This only applies as long as you spend the money on your campaign or save it in a fund for future politicking. Persons who donate goods to nonprofit charitable organizations or state or local government entities are exempt from use tax if they have had no intervening use of the goods. It is not designed to answer all.

Common activities that are usually not taxed because they are related to a nonprofits purpose. Some have thousands of employees while others employ a couple of key people and rely on. There are certain circumstances however they may need to make payments.

Other nonprofits are not charities like museums and libraries. Here we break down what tax deductible means and how you can use it to your advantage. For the most part nonprofits are exempt from most individual and corporate taxes.

Nonprofit Organizations for Sales and Use Income and Withholding Taxes Revised December 2009 INFORMATION 7-215-1992 Rev. Do nonprofits pay taxes. Gift taxes are the responsibility of the person giving the gift.

The state of Iowa requires you to pay taxes if you are a resident or nonresident who receives income from an Iowa source. Generally donations of gift cards gift certificates checks cash or services are not subject to tax since there is not an exchange of merchandise or goods. Over 3359 tax filings for nonprofits of all sizes.

However this corporate status does not automatically grant exemption from federal income tax. In short the answer is both yes and no. Two bills in the Montana Legislature that threatened nonprofit property tax exemptions were tabled.

To be tax exempt most organizations must apply for recognition of exemption from the Internal Revenue Service to. Recipients do not report them on their taxes. Donations to pay someones medical or educational expenses are not.

So the first umbrella income related to your exempt purpose is relatively simple. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the nonprofit corporations tax-exempt purposes. One of the best ways you can encourage people to donate to your non-profit organization is by assuring them that their donation is tax-deductible.

As of 2014 that amount was 14000. A hardware store donates an industrial pressure washer to a nonprofit community center for neighborhood cleanup. Gifts or money you received as a present isnt taxable but you do owe taxes on any income it produces.

Internal Revenue Code lists 27 types of nonprofit organizations exempt from tax. Most nonprofits have paid staff. State tax exempt benefits vary by state but most include.

Amount and types of deductible contributions what records to keep and how to report contributions. Ad Experts in nonprofit bookkeeping. There are clear rules as well as several exceptions to.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. Do i need to pay tax on donations that were given to me.

A searchable database of organizations eligible to receive tax-deductible charitable contributions. State and local property taxes state income tax and sales tax on purchases. Donations are a critical piece of nonprofit accounting basics.

How donors charities and tax professionals must report non-cash charitable contributions. For example if you receive bonds as a gift you must report any interest the bonds earned after you received them. One would have required charitable nonprofits to pay property taxes for ten years on any new real property purchased or donated.

12-2009 Supersedes 7-215-1992 Rev. However they arent completely free of tax liability. A brief description of the disclosure and.

While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. There are some instances when nonprofits and churches are still required to pay taxes. For the 2021 tax year you can deduct up to 300 per person rather than per tax return meaning a married couple filing jointly could deduct up to 600 of donations without having to itemize.

Any nonprofit that hires employees will also. If you run for office -- whether its city councilor or president -- any donations to your campaign are tax-free income. Which Taxes Might a Nonprofit Pay.

Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. Some nonprofits are tax exempt meaning they do not have to pay federal corporate income tax. In general a person can give any individual a certain amount each year without triggering gift tax.

Take the stress out of tax prep. If you receive 7000 in your city council campaign spend 5500 and pocket the rest thats 1500 in personal income you have to report. Under the second umbrella Unrelated Business Taxable Income UBTI there is a long set of rules used.

Even though the federal government awards federal tax-exempt status a state can require additional documentation to. Tracking nonprofit donations.

Non Profit Budget Budget Template Donation Letter Template Budgeting

Non Profit Donation Letter For Taxes Google Search Fundraising Letter Non Profit Donations Donation Letter

Fundraising Infographic Fundraising Infographic A Brief History Of Charitable Giving Visual Ly Charitable Giving Infographic Charitable

Charitable Donation Receipts Requirements As Supporting Documents For Tax Deductible Donations Donation Letter Donation Letter Template Donation Form

How To Start A Nonprofit In 4 Parts Nonprofit Startup Start A Non Profit Nonprofit Management

Benefits Of Bookkeeping Bookkeeping Accounting Fiscal Year

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Tax Deductions For Charitable Contributions Donations Charitable Contributions Fundraising Donations Profitable Fundraisers

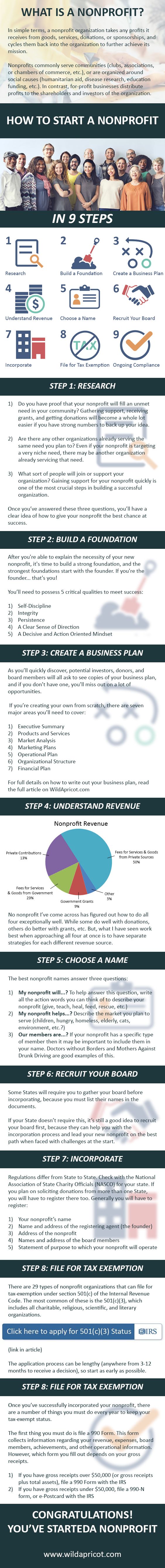

Infographic What Is A Nonprofit By Cullinane Law For Any Assistance Related To Legal Aspect Of Nonp Nonprofit Startup Start A Non Profit Nonprofit Marketing

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors Chart Of Accounts Accounting Nonprofit Organization

44 Holiday Email Templates For Small Businesses Nonprofits Email Templates Holiday Emails Giving Tuesday

How To Start A Non Profit Organization In Pennsylvania Paperwork Cost And Time Http Localhost Inform Start A Non Profit Non Profit Nonprofit Organization

Nonprofits Need To Have An Excellent Board Nonprofit Information Fundraising Methods Personal Fundraising Fundraising

Social Fundraising Tools For Nonprofits Causes Nonprofit Startup Fundraising Marketing Fundraising Activities

The Inspiring 10 Treasurers Report Template Resume Samples For Fundraising Report Template Photo Below Is Other Budget Template Budgeting Budget Spreadsheet

Click To View The Full Size Infographic On Corporate Sponsorship Sponsorship Proposal Nonprofit Startup Sponsorship Levels

Sponsorship Levels Event Sponsorship Donation Letter

Monthly Calendar Fundraiser Photo Marketing Plan Template Fundraising Marketing Nonprofit Fundraising